Since 2006, the role of Medicare Advantage, the private plan alternative to traditional Medicare, has steadily grown. In 2022, more than 28 million people are enrolled in a Medicare Advantage plan, accounting for nearly half or 48 percent of the eligible Medicare population, and $427 billion (or 55%) of total federal Medicare spending (net of premiums). The average Medicare beneficiary in 2022 has access to 39 Medicare Advantage plans, the largest number of options available in more than a decade.

To better understand trends in the growth of the program, this brief provides current information about Medicare Advantage enrollment, including the types of plans in which Medicare beneficiaries are enrolled, and how enrollment varies across geographic areas. A second, companion analysis describes Medicare Advantage premiums, out-of-pocket limits, cost sharing, extra benefits offered, prior authorization requirements, and star ratings in 2022.

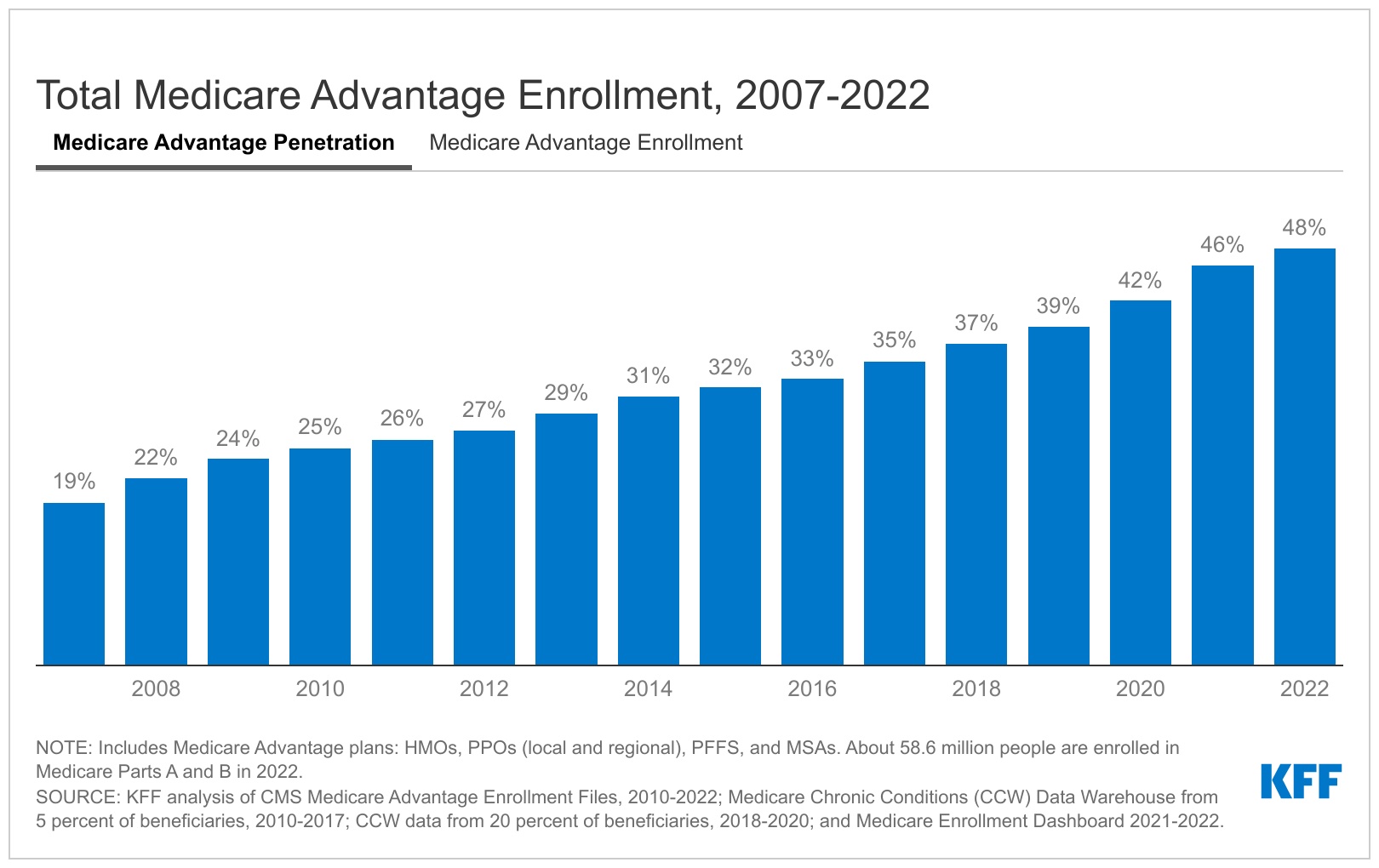

The share of eligible Medicare beneficiaries enrolled in Medicare Advantage has more than doubled since 2007

In 2022, nearly half of (48%) eligible Medicare beneficiaries – 28.4 million people out of 58.6 million Medicare beneficiaries overall – are enrolled in Medicare Advantage plans. Medicare Advantage enrollment as a share of the eligible Medicare population has more than doubled from 2007 to 2022 (19% to 48%). KFF now calculates the share of eligible Medicare beneficiaries enrolled in Medicare Advantage, meaning they must have both Part A and B coverage. This affects both 2022 data as well as trends over time. The share would be somewhat smaller if based on the total Medicare population that includes 5.7 million beneficiaries with Part A only or Part B only who are not generally eligible to enroll in a Medicare Advantage plan. See methods for more details.

Between 2021 and 2022, total Medicare Advantage enrollment grew by about 2.2 million beneficiaries, or 8 percent – a slightly slower growth rate than the prior year (10%). The Congressional Budget Office (CBO) projects that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will rise to 61 percent by 2032 (Figure 2).

In 2022, two-thirds of Medicare Advantage enrollees are in individual plans that are open for general enrollment

Two-thirds (66%) of Medicare Advantage enrollees, or 18.7 million people, are in plans generally available to all beneficiaries for individual enrollment. That is an increase of 1.3 million enrollees compared to 2021. Individual plans have accounted for approximately the same share of total Medicare Advantage enrollment since 2018.

Nearly one in five Medicare Advantage enrollees (18%) are in group plans offered to retirees by employers and unions in 2022

Nearly 5.1 million Medicare Advantage enrollees are in a group plan offered to retirees by an employer or union. While this is roughly the same share of enrollment since 2010 (18%), the actual number has increased from 1.8 million in 2010 to 5.1 million in 2022 (Figure 4). With a group plan, an employer or union contracts with an insurer and Medicare pays the insurer a fixed amount per enrollee to provide benefits covered by Medicare. For example, some states, such as Illinois and Pennsylvania, provide health insurance benefits to their Medicare-eligible retirees exclusively through Medicare Advantage plans. As with other Medicare Advantage plans, employer and union group plans often provide additional benefits and/or lower cost sharing than traditional Medicare and are eligible for bonus payments. The employer or union (and sometimes the retiree) may also pay an additional premium for these supplemental benefits. Group enrollees comprise a disproportionately large share of Medicare Advantage enrollees in six states: Alaska (99%), Michigan (42%), Maryland (36%), West Virginia (35%), New Jersey (35%), and Illinois (30%).

More than 4.6 million Medicare beneficiaries are enrolled in Special Needs Plans in 2022

More than 4.6 million Medicare beneficiaries are enrolled in Special Needs Plans (SNPs). SNPs restrict enrollment to specific types of beneficiaries with significant or relatively specialized care needs, or who qualify because they are eligible for both Medicare and Medicaid. The majority of SNP enrollees (89%) are in plans for beneficiaries dually enrolled in both Medicare and Medicaid (D-SNPs). Another 9 percent of SNP enrollees are in plans for people with severe chronic or disabling conditions (C-SNPs) and 2 percent are in plans for beneficiaries requiring a nursing home or institutional level of care (I-SNPs).

While D-SNPs are designed specifically for dually-eligible beneficiaries, 1.9 million Medicare beneficiaries with Medicaid were enrolled in non-SNP Medicare Advantage plans in 2020 (the most recent year for which this data is available).

Enrollment in SNPs increased from 3.8 million beneficiaries in 2021 to 4.6 million beneficiaries in 2022 (20% increase), and accounts for about 16% of total Medicare Advantage enrollment in 2022, up from 11% in 2011, with some variation across states. In the District of Columbia and Puerto Rico, SNPs comprise about half of all Medicare Advantage enrollees (47% in DC and 48% in PR). In 11 states, SNP enrollment accounts for about one-fifth of Medicare Advantage enrollment (29% in MS, 27% in NY and in LA, 24% in AR and in FL, 23% in GA, 22% in SC, 21% in CT, and 20% in TN, in AZ, and in HI). More than 95% of C-SNP enrollees (about 380,000 people) are in plans for people with diabetes or cardiovascular conditions in 2022. Enrollment in I-SNPs has been increasing slightly, but is still fewer than 100,000.

The share of Medicare beneficiaries in Medicare Advantage plans, by state, ranges from 1% to 59%

The share of Medicare beneficiaries in Medicare Advantage plans varies across the country, but in 25 states, at least half of all Medicare beneficiaries are enrolled in Medicare Advantage plans. In contrast, Medicare Advantage enrollment is relatively low (less than 20 percent) in four mostly rural states (SD, ND, WY, and AK). Overall, Puerto Rico has the highest Medicare Advantage penetration, with 93 percent of Medicare beneficiaries enrolled in a Medicare Advantage plan. This may be due in part to the high share of beneficiaries in Puerto Rico with low incomes who are dually enrolled in Medicare and Medicaid, as noted above.

The share of Medicare beneficiaries in Medicare Advantage plans varies widely across counties

The share of Medicare beneficiaries enrolled in Medicare Advantage varies widely across counties. For example, in Florida, 56% of all Medicare beneficiaries in the state are enrolled in Medicare Advantage, ranging from 19% in Monroe County (Key West) to 78% in Miami-Dade County. In Ohio, 52% of all Medicare beneficiaries are enrolled in Medicare Advantage, with the share ranging from 30% in Mercer County (Celina) to 64% in Stark County (Canton).

In 2022, one in five (21%) Medicare beneficiaries live in a county where at least 60 percent of all Medicare beneficiaries in that county are enrolled in Medicare Advantage plans (321 counties). That is substantially more than in 2010 when just 3 percent of the Medicare population lived in a county where 60 percent or more of Medicare beneficiaries were enrolled in a Medicare Advantage plan (83 counties). Many counties with high Medicare Advantage penetration are centered around relatively large, urban areas, such as Monroe County, NY (78%), which includes Rochester, and Allegheny County, PA (72%), which includes Pittsburgh. However, some urban areas, such as Baltimore City, MD (33%), Charleston, SC (33%), and Cook County, IL (Chicago, 39%) have lower Medicare Advantage enrollment.

UnitedHealthcare and Humana account for nearly half of all Medicare Advantage enrollees nationwide in 2022

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana together account for 46 percent of all Medicare Advantage enrollees nationwide. In nearly a third of counties (29%; or 945 counties), these two firms account for at least 75% of Medicare Advantage enrollment. (BCBS affiliates (including Anthem BCBS plans) account for 14 percent of enrollment, and four firms (CVS Health, Kaiser Permanente, Centene, and Cigna) account for another 24 percent of enrollment in 2022.

UnitedHealthcare and Humana have consistently accounted for a relatively large share of Medicare Advantage enrollment

UnitedHealthcare has had the largest share of Medicare Advantage enrollment and largest growth in enrollment since 2010, increasing from 20 percent of all Medicare Advantage enrollment in 2010 to 28 percent in 2022. Humana has also had a high share of Medicare Advantage enrollment, though its share of enrollment has grown more slowly, from 16 percent in 2010 to 18 percent in 2022. BCBS plans share of enrollment has been more constant over time, but has declined moderately since 2014. CVS Health, which purchased Aetna in 2018, has seen its share of enrollment nearly double from 6 percent in 2010 to 11 percent in 2022. Kaiser Permanente now accounts for 6% of total enrollment, a moderate decline as a share of total since 2010 (9%), mainly due to the growth of enrollment in plans offered by other insurers and only a modest increase in enrollment growth for Kaiser Permanente over that time. However, for those insurers that have seen declines in their overall share of enrollment, the actual number of enrollees for each insurer is larger than it was in 2010.

For the sixth year in a row, enrollment in UnitedHealthcare’s plans grew more than any other firm, increasing by more than 749,000 beneficiaries between March 2021 and March 2022. Centene had the second largest growth in plan year enrollment, which was a little less than half of UnitedHealthcare’s with an increase of about 306,000 beneficiaries between March 2021 and March 2022. BCBS plans had the third highest growth in plan year enrollment of 293,000 beneficiaries between March 2021 and March 2022. CVS Health had the fourth largest growth in plan enrollment with an increase of about 282,000, followed by Humana, increasing by about 250,000 beneficiaries between March 2021 and March 2022. However, Cigna actually lost enrollees, declining by about 12,000 between March 2021 and March 2022.

Discussion

Medicare Advantage enrollment has increased steadily since 2006, with nearly half (48%) of all eligible Medicare beneficiaries enrolled in Medicare Advantage plans in 2022. The share of Medicare Advantage enrollees varies across the country: in 25 states and Puerto Rico, at least 50 percent of Medicare beneficiaries are enrolled in Medicare Advantage plans in 2022. In a growing number of counties, 60 percent or more of all Medicare beneficiaries are in a Medicare Advantage plan, in lieu of traditional Medicare. Enrollment continues to be highly concentrated among a handful of firms, both nationally and in local markets, with UnitedHealthcare and Humana together accounting for 46 percent of enrollment in 2022.

As Medicare Advantage takes on an even larger presence in the Medicare program, and with current payments to plans higher for Medicare Advantage than for traditional Medicare for similar beneficiaries, it will be increasingly important to assess how well Medicare’s current payment methodology for Medicare Advantage is working to enhance efficiency and hold down beneficiary costs and Medicare spending. It will also be important to monitor how well beneficiaries are being served in both Medicare Advantage and traditional Medicare, in terms of costs, benefits, quality of care, patient outcomes, and access to providers, with particular attention to those with the greatest needs.

Meredith Freed, Jeannie Fuglesten Biniek, Tricia Neuman are with KFF.

Anthony Damico is an independent consultant.

| This analysis uses data from the Centers for Medicare & Medicaid Services (CMS) Medicare Advantage Enrollment, Benefit and Landscape files for the respective year. KFF uses the Medicare Enrollment Dashboard for enrollment data, from March of each year.

In previous years, KFF had calculated the share of Medicare beneficiaries enrolled in Medicare Advantage by including Medicare beneficiaries with either Part A and/or B coverage. We have modified our approach this year to estimate the share enrolled among beneficiaries eligible for Medicare Advantage who have both Medicare Part A and Medicare B. In the past, the number of beneficiaries enrolled in Medicare Advantage was smaller and therefore the difference between the share enrolled with Part A and/or B vs Part A and B was also smaller. For example, in 2010, 24% of all Medicare enrollees were in enrolled in Medicare Advantage versus 25% with just Parts A and B. However, these shares have diverged over time: in 2022, 44% of all Medicare enrollees were in enrolled in Medicare Advantage versus 48% with just Parts A and B. These changes are reflected in both the 2022 data and in data displayed trending back to 2010. Additionally, in previous years, KFF had used the term Medicare Advantage to refer to Medicare Advantage plans as well as other types of private plans, including cost plans, PACE plans, and HCPPs. However, cost plans, PACE plans, HCPPs are now excluded from this analysis in addition to MMPs. In this analysis, KFF excludes these other plans as some may have different enrollment requirements than Medicare Advantage plans (e.g., may be available to beneficiaries with only Part B coverage) and in some cases, may be paid differently than Medicare Advantage plans. These exclusions are reflected in both the 2022 data and in data displayed trending back to 2010. Enrollment counts in publications by firms operating in the Medicare Advantage market, such as company financial statements, might differ from KFF estimates due to inclusion or exclusion of certain plan types, such as SNPs or employer group health plans. |